mobile county al sales tax form

In Mobile Downtown office is. Sales Tax General Gross.

Application For Sales Tax Certificate Of Exemption Alabama

This rate includes any state county city and local sales taxes.

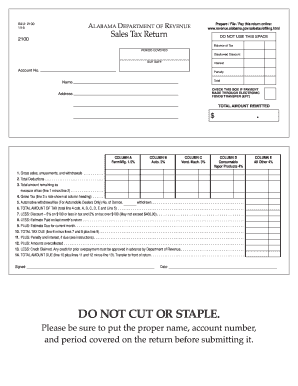

. Please call the Sales Tax Department at 251-574-4800 for additional information. To obtain a payment amount for a delinquent tax account please contact our Collections Department at 251-574-8530. Sales And Use Tax.

Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama by businesses located in Alabama. Opsoreang July 23 2022 0 Comments. The current total local sales tax rate in Mobile County AL is 5500.

Joint Petition for Refund. VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION. Sales Tax Form 12.

Board of Equalization-Appeals Form. Food Beverage Tax Form 7. Online Filing Using ONE SPOT-MAT.

Sales Tax Application Authorization Certificate of Good Standing Request Corporate Officer Change Itinerant Vendor Application Lodging Tax Return Petition for Refund Power of Attorney. Mobile County Al Sales Tax Form. Box 327790 Montgomery AL 36132-7790 About the Division Sales and Use Tax.

Please print out the forms complete and mail them to. 800 to 300 monday tuesday thursday and fridays and 800 to 100 wednesdays. Download all Alabama sales tax rates by zip code The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe.

10 Auto 05 Consumers Use Tax General Gross. 3 If you are an established. Return to Top My property was sold in the tax sale.

Property record and appraisal information are for appraisal use only and. 2020 rates included for use while preparing your income tax deduction. Leasing Tax Form 3.

Mobile County Tax Rates. The latest sales tax rate for Mobile AL. Information Motor Vehicle Business License Sales Tax Online Filing Using ONE SPOT-MAT.

City of Mobile Government Revenue Sales And Use Tax Sales and Use Tax Sales and Use taxes have replaced the decades old Gross Receipts tax. 2 Choose Tax Type and Rate Type that correspond to the taxes being reported. Alabama Department of Revenue Sales Use Tax Division P.

Mobile County Alabama Sales Tax Rate 2022 Up to 10 The Mobile County Sales Tax is 15 A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the. Business License Renewals. Petition for Release of Penalty.

City of Mobile Business LIcense Overview City of Mobile Alcoholic Beverage Application Business License Application Seller Use Tax Tax Form 13 Sales Tax Form 12 Petition for Release of. Mobile County Revenue Commission PLEASE REMEMBER THAT ALL LOCATIONS ARE CLOSED ON WEDNESDAYS COUNTY TAX LIENS Here are the current tax liens available for. In Mobile or our Downtown Mobile office at 151 Government St.

Montgomery AL 36104 Mailing Address. The December 2020 total local sales tax rate was also 5500. The tax is collected by the seller from their.

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd.

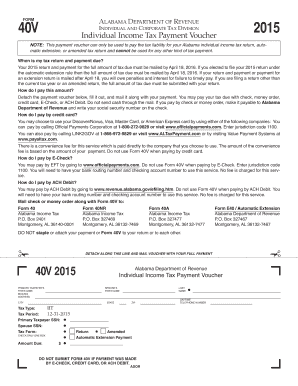

40v 20 Alabama Department Of Revenue Alabama Gov Fill Out And Sign Printable Pdf Template Signnow

Where S My Refund Alabama H R Block

Job Opportunities Sorted By Job Title Ascending Mobile County Personnel Board Career Site

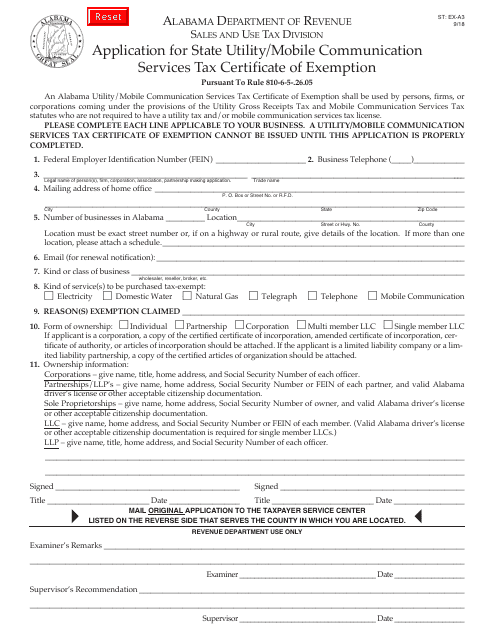

Form St Ex A3 Fillable Application For State Utility Mobile Communication Services Tax Certificate Of Exemption And Instructions

Alabama Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

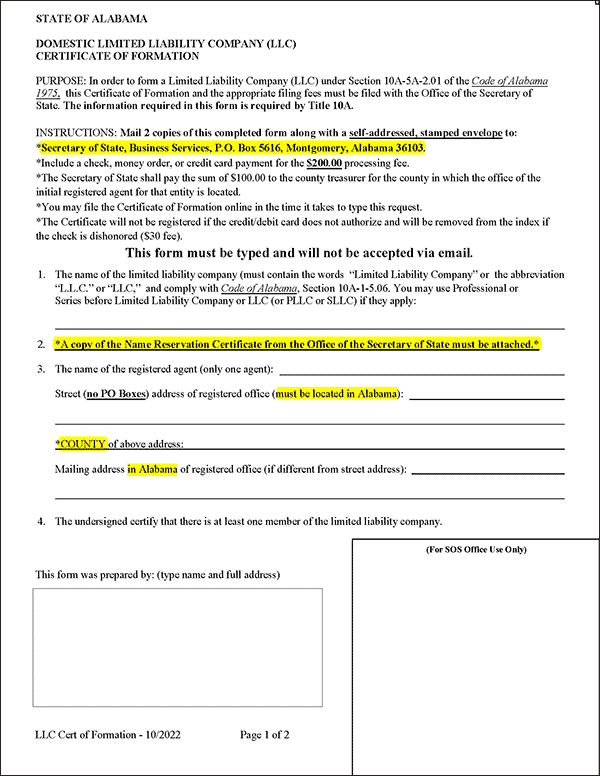

Alabama Llc How To Start An Llc In Alabama In 11 Steps Starting Up 2022

Mobile County Health Department A Legacy Of Excellence Since 1816

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Alabama Tax Fill Online Printable Fillable Blank Pdffiller

Sales Taxes In The United States Wikipedia

Alabama Sales Tax Return Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Alabama Department Of Revenue