stop quote vs trailing stop quote

A trailing stop order is designed to allow an investor to specify a limit on the maximum possible loss without setting a limit on the maximum possible gain. Stop Quote limit order is a combination of both a stop quote and a limit order.

Pin By Ben Petithomme On 4 Hour Work Wek Trading Quotes Stock Trading Strategies Trading Charts

By following these steps youll have placed a.

. Open a stock trade ticket. For example a sell trailing stop order sets the. Trailing Stop Limit vs.

Stop orders are triggered when the market trades at or through the stop price depending upon trigger method the default for non-NASDAQ listed stock is last price and then a market order is transmitted to the exchange. Etrade changed the stop loss function some time ago. However the stop price will adjust with changes to the national best bid or offer for the security.

With a stop limit order after a certain stop price is reached the order turns into a limit order and an asset is bought or sold at a certain price or better. Generally a Stop on Quote is called a stop loss or stop order a stop limit on quote is called a stop limit and a trailing stop is well. A buy stop is placed above the current market price.

An Overview Traders can have more control over their trades by using stop-loss or stop-limit orders. Sell order for stop quote limit order is placed when the price is below the stocks current market price and it will trigger when the price is lower than the decided price. A normal stop order will turn into a.

If the stock suddenly crashes to 7 making your sell order at 7 the broker wouldnt execute the stop loss because it is below your limit of 850. For example some theories employ general stops such as a 6 trailing stop set on all stocks. In this example we are going to set the limit offset.

A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop priceIt is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far. Under Stop Price type 95. The trailing stop is a moving target following a trade.

When the price hits 90 it will. While a stop loss is set at the trade entry to cap a loss a trailing stop is moving to maximize a gain as a trade goes in your favor. The Trailing Stop orders works with US equities options futures FOPS Warrants as well as Forex and certain and certain non-US products.

The stop price should be set strategically to minimize loss. A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock. A sell stop order is placed below the current market price.

Enter the stock symbol. Bad thing about SLOQ is if there isnt a good BID support you may take a huge loss from what you set your price at as the computer works its way down the BID side selling. Trailing Stop Loss From the examples above it may seem like a trailing stop limit is the obvious choice due to its greater flexibility However do remember that although limit orders allow you to have a lot more control over your trades they also carry additional risks.

A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. So you set a stop loss at 90. Limit and Stop-Loss Orders In conclusion limit and stop-loss orders are two of the most commonly used and popular order types when trading stocks because they offer the investor more control over how they react to the markets price discovery process than standard market orders where the investor is agreeing to pay whatever the current market price is.

Designed to initiate a sale or purchase when a securities price hits a certain point. A stop-loss order triggers a market order when a designated price is hit. To do this first create a SELL order then click select TRAIL LIMIT in the Type field and enter 020 in the Trailing Amt field.

It places a limit on your loss so that you dont sell too low. It enables an investor to have some downside. A trailing stop is an exit strategy that triggers a stop when a price reverses back enough to signal the possibility that a trend is possibly coming to an end.

Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. Under Order Type select SELL along with the quantity 100 shares in this example Under Price Type Select Stop on Quote. In a trailing stop limit order you specify a stop price and either a limit price or a limit offset.

These orders are similar to stop limit on quote and stop on quote orders. For example if you set a stop order with a stop price of 100 it will be triggered only if a valid quote at 100 or better is met. Say you own XYZ right now at 100share but youre afraid itll go down.

The trail value can be a fixed dollar amount or a percentage. This can be either a buy stop quote or a sell stop quote depending on whether the current market price is above or below the specified stop. Learn how Stop Market Stop Limit and Trailing Stop orders can help protect your investments or cap lossesOpen an account.

A trailing stop limit is an order you place with your broker. Click the Preview button at the bottom of the Trade Ticket page. Can help protect potential profits while providing downside protection.

For example say you have a stock trading at 10 and you put a stop loss at 9 and a stop limit at 850. A stop limit order is a combination of a stop order and a limit order. If the calculated stop price is reached the order will be activated and become a market order.

Stop on Quote vs. A stop-limit-on-quote order is an order that an investor places with their broker which combines both a stop-loss order and a limit order. Learn how to use a trailing stop loss order and the effect this strategy may have on your investing or trading strategy.

As mentioned before a stop quote simply gets triggered once the market price hits that specified stop quote. A trailing stop order is similar to a traditional stop quote order. The limit price is then calculated as Stop Price Limit Offset.

There are different types of stop order approaches and they have diverse applications based on the timing strategies used.

In This Article Discover How To Use A Trailing Stop Loss When Trend Trading Stocks Trend Trading Trading Quotes Trading Charts

T Stop Best Trailing Stop Indicator For Ninjatrader 8 Ninza Co Paint Charts Rsi Solar Wind

Trailing Stop Stop Loss Combo Leads To Winning Trades Loss Trading Led

I Heard The Sound Of Small Feet Trailing Me Followed By His Words It S Okay Mom I Pushed The Hair Off My Fore Smart Parenting Words Parenting Inspiration

As Part Of Your Trading Strategy You Should Use A Trailing Stop Loss Instead Of A Fixed Profit Target In A Good Tre Trend Trading Trading Quotes Trade Finance

How To Use A Trailing Stop Loss Show Me The Money Animal Quotes Loss

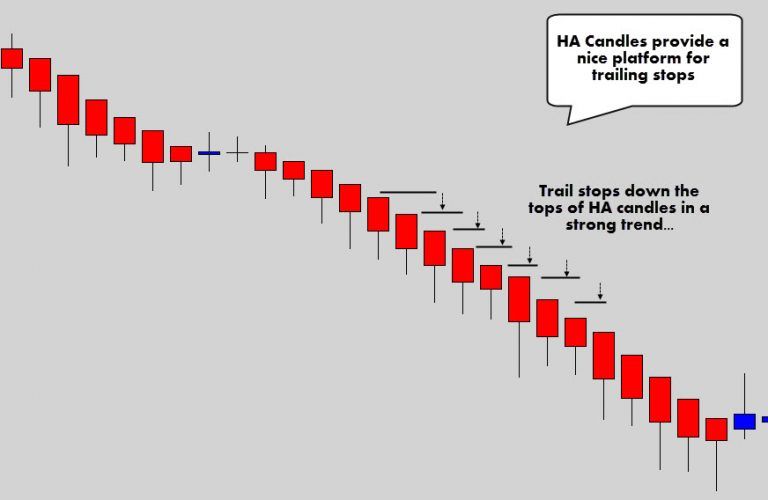

Ha Trailing Stops Trading Charts Wave Theory Trading Quotes

Do You Use Trailing Stops While Trading Trailing Stops Are A Great Tool To Use When It Comes To Locking In Profits Or Limiti Investing Value Investing Trading

Bollinger Bands With 200 Ema Is A Strategy For Trading For Short Time Frame 15 Min Or 5 Min Then Is A Trading System For Trading Quotes Forex Intraday Trading

1 248 Me Gusta 26 Comentarios Forex Training And Strategies Profxtrades En Instagram Do You Us Trading Charts Stock Trading Strategies Intraday Trading

Lifestyle Business Love Art Wealth Mindset Quotes Entrepreneurlife Entrepreneurship Smallbusiness Hap Investing Business Mentor Investment Portfolio

How To Use A Trailing Stop Loss While Day Trading Day Trading Trading Charts Online Stock Trading

Stop And Take A Moment To Admire All The Things That You Take For Granted Every Day Inspirational Quotes All Quotes Words

The Aggressive One Bar Trailing Stop Loss For Quick Trades Trading Investment Advice Swing Trading

Trailing Stop Losses In 2022 Forex Trading Strategies Learn Forex Trading Forex Trading

What Is Trailing Stop How To Use It To Make More Profits In Forex Trading Charts Forex Profit

Trading Plan Stock Trading Strategies Online Stock Trading Forex Trading Quotes

Trailing Stop Loss Trading Trading Charts Trade Finance Technical Trading

T Stop Best Trailing Stop Indicator For Ninjatrader 8 Ninza Co Intraday Trading Trading Strategies Forex Trading Strategies